How Artificial Intelligence Drives Cryptocurrency Trading

This article examines how Artificial Intelligence (AI) drives cryptocurrency trading, focusing on how AI pairs with blockchain technology and empowers cryptocurrency trading bots to develop and sustain the cryptocurrency market.

Invention is the mainstay of human advancement. Ancient technology produced crude human inventions such as stone, wood, bone, and metal tools used especially for cutting, smashing, hunting, making fire and weaponry. Fast forward to the contemporary age and the invention of the computer has engendered a better life through modern technology. Having evolved from four previous phases, namely vacuum tubes, transistors, integrated circuits, and microprocessors, the fifth and current artificially intelligent generation of computers meets present technological needs with an assured prospect of greater future offers.

Since its emergence, Artificial Intelligence (AI) is being integrated with advanced technologies in key aspects of the global economy. One such technology is blockchain. Involving a network of computers, blockchain is a database for storing and securing transactions of cryptocurrencies which are digital means of exchange.

Subsequent to the launching of bitcoin in 2009, more than 18,000 new cryptocurrencies have surfaced and they are presently and accumulatively worth trillions of dollars. The 24-hour cryptocurrency market has grown tremendously into one of the globe's most substantial financial evolution. As of 14th April 2021, the global crypto market cap and total crypto market volume in 24 hours are estimated at $1.92 trillion and $81.07 billion, sequentially.

Despite increased global interest in cryptocurrency, many shy away from cryptocurrency trading because it is highly demanding and time-consuming. Outstandingly, cryptocurrency trading bots created to ease the entire trading process are enabled to collect data required for analyses and correct predictions of ever-volatile crypto prices by AI and machine learning. The crypto trading bots undertake automated trades based on the predictions twenty-four hours a day, saving traders time for other commitments while engaged in the cryptocurrency business.

Cryptocurrency bots

Cryptocurrency trading robots are computer programs developed with advanced algorithms to simplify, rationalize, and boost the profitability of cryptocurrency trading for deployers who constitute approximately 40% of crypto users world-wide. Relying on data-driven indications facilitated by AI, crypto trading bots monitor market levels, react to price movements, and execute timely and profit-making orders that entail the buying and selling of cryptocurrencies to the utmost advantage of newbie and professional investors.

Specific functions

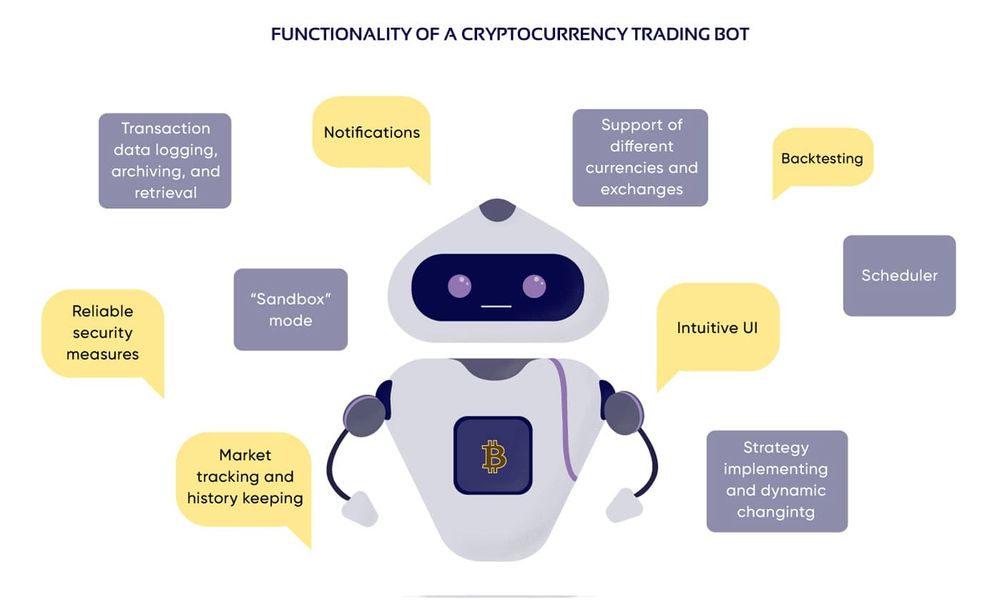

A standard cryptocurrency bot must be able to implement a dynamic trading strategy and incorporate a scheduler that actualizes the autonomous execution of the strategy. A competent one tracks markets, obtains and keeps records and past transactions for future retrieval, reference, and analysis. An effective one is backtested against historical data and/or supports trade simulation which helps traders hone their skills cost-free. Also, a perfect one supports cryptocurrency exchanges while ensuring the security of users' accounts and transactions.

The aforementioned functions and more capacitate every trading bot to automate end users' trading strategies. The roles realize bots' automated, correct, profitable purchases and trades, promoting users' efforts to achieve a 24-hour competitive edge on the market. Trading bots depend on technical indicators for profit-maximizing transactions. Many of them do not require coding skills to be set-up and productively used. Some trading bots are free and others used by subscription.

Quick fact 1: Cryptocurrency exchange

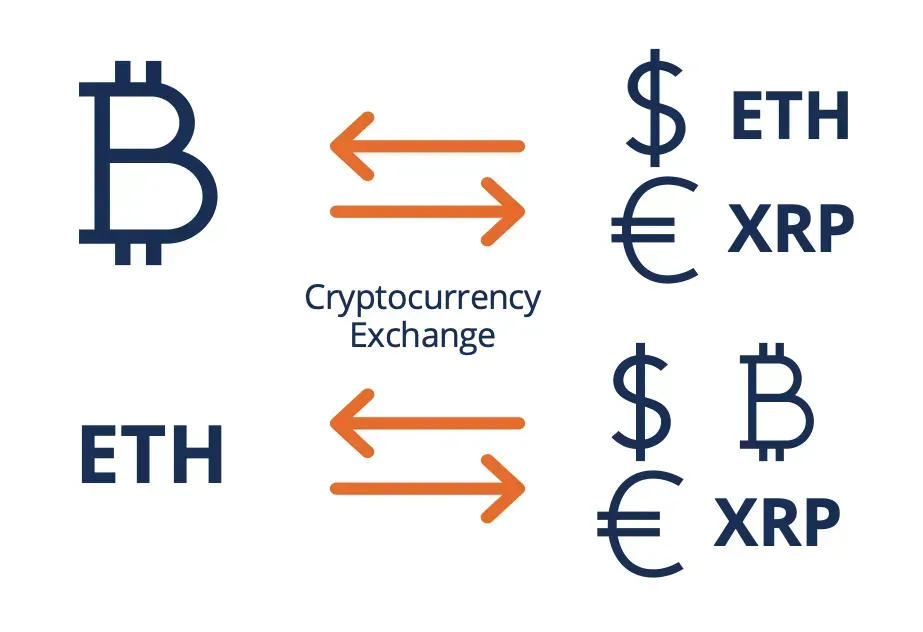

A cryptocurrency exchange operates like a stock exchange. It is an online platform where cryptocurrency traders buy and sell digital currencies such as bitcoin. An exchange provides an Application Programming Interface (API) for communication between systems to enable data linkage, data retrieval, and trading actions. An exchange can be centralized (a central authority stores and trades virtual assets) or decentralized (operating without a central authority). Some recognized cryptocurrency exchanges are Binance, Binance.US, Bitfinex, Coinbase Exchange, Crypto.com Exchange, FTX, Kraken, KuCoin, Gate.oi, and Huobi Global.

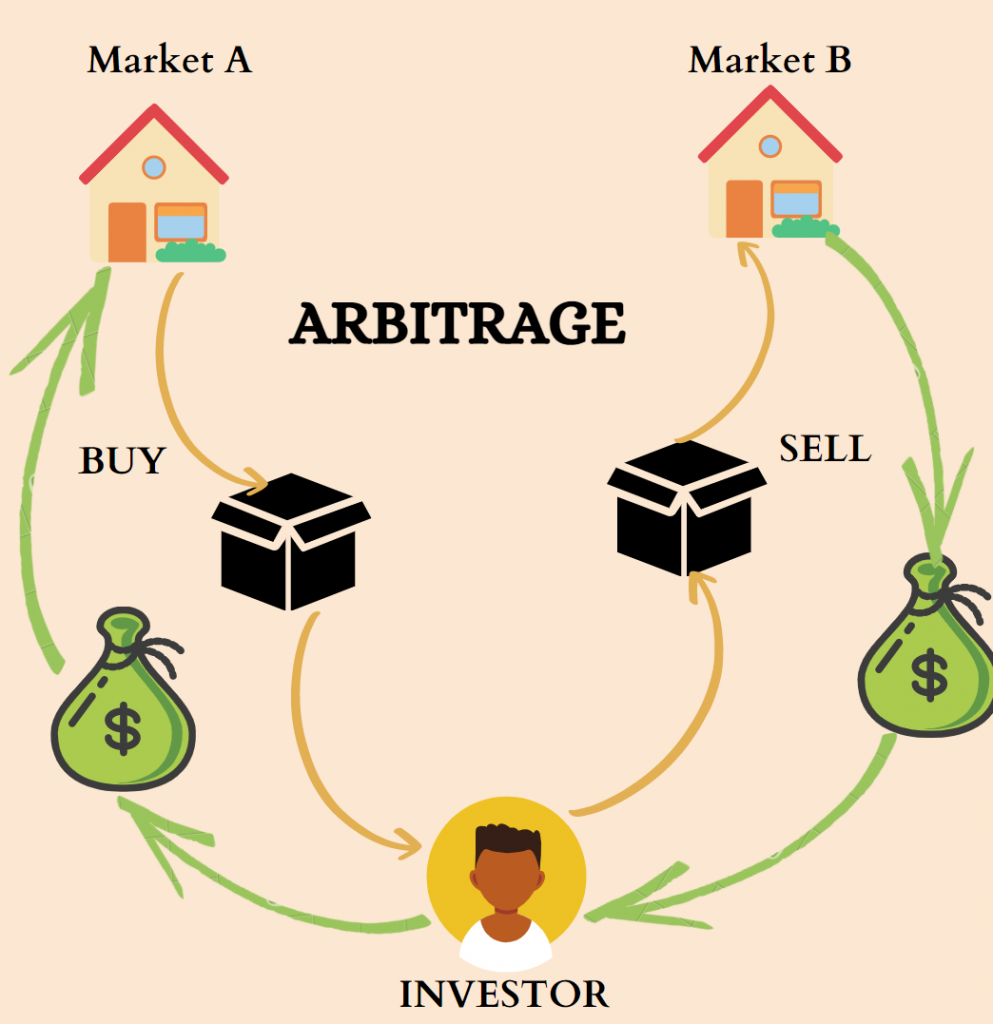

Cryptocurrency Arbitrage Bots

Crypto arbitrage involves the purchase of cryptocurrency from one exchange at a low price and its sale on another exchange where the price is high, augmenting profits adequately. Price differences are perpetually volatile, making accurate predictions for bitcoin exchanges humanly difficult. As data value changes on the market, arbitrage trading bots can become aware of money making positions and independently execute gainful orders for investors. Accordingly, the arbitrage bots buy digital currencies on exchanges where they are cheap and sell on exchanges where they trade high. Some cryptocurrency arbitrage bots are 3Commas, Bitsgap, and Cryptohopper.

3Commas

3Commas is a user-friendly trading bot that traders without coding skills can use well. Having a simple and highly-visual interface, 3Commas possesses advanced features such as complex but highly profitable trading options that are best managed by experienced cryptocurrency traders. Providing smart trade, 3Commas makes automated, well-controlled, gainful purchases and sales on exchanges to boost traders' investments. 3Commas offers both yearly and discounted biannual subscriptions, and supports popular exchanges, inclusive of Binance, FTX, Binance US, Gate.io, Huobi, Kraken, and KuCoin.

Quick fact 2: Cryptocurrency bot trading indicators

Cryptocurrency bot trading indicators are predictive tools which provide technical analysis that influences right trading decisions. There are momentum, volatility, trend, and volume indicators.

A momentum indicator (e.g., the Relative Strength Index [RSI]) assesses price changes overtime to give important insights into current market positions.

A volatility indicator (e.g., the Bollinger Bands [BB]) indicates market volatility, which can be high (risky) or low (less risky).

A trend indicator (e.g., the Moving Average Convergence/Divergence [MACD]) analyzes past market movements, tendering a unique, multidimensional approach to trading.

A volume indicator (e.g., the On-Balance Volume (OBV) analyzes the market's trading volume and reflects asset performance. Zignaly

Bitsgap

Bitsgap is an automated bitcoin trading bot that helps users to make profit on every market move notwithstanding the price direction, thus constantly stabilizing gains. Easily set up and deployed, Bitsgap executes trades at an incredible speed that beats market volatility. Bitsgap applies 130+ indicators and puts a trading chart view for performance assessment at the disposal of traders. Bitsgap is available on almost 30 brokerages and supports exchanges such as Binance, Bitfinex, Coinbase Exchange, FTX, Kraken, KuCoin, and Huobi Global. Bitsgap can support multiple exchanges simultaneously.

Cryptohopper

Cryptohopper is an automated crypto trading bot deployable without any coding experience. Effortlessly built, Cryptohopper uses AI to predict and benefit from market movements such as trades performed, price ranges, trading volume and patterns. Cryptohopper applies 130+ indicators, including candle patterns, to train professional traders and make mainly data-driven trading decisions and transactions on their behalf. Offering a monthly subscription package, Cryptohopper can track up to 75 coins concurrently and compare their metrical performance with users' chosen profit aims, indicators and choices. Cryptohopper supports many exchanges, including Binance, Bitfinex, Kraken, KuCoin, and Huobi Global.

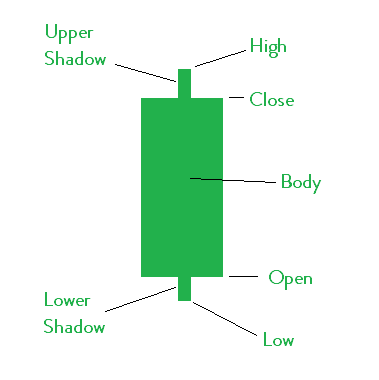

Quick fact 3: Candle patterns

"Candle patterns are visual indicators of how a security, derivative, or crypto asset has moved within a certain period. A period can be a minute, an hour, a week, a month, or any other set time frame." - Coin rivet

Disadvantages of cryptocurrency bots

Users of cryptocurrency trading bots are likely to encounter one or more issues. No system is 100% efficient, a major reason why crypto trading bots may make unanticipated, unfavorable transactions on behalf of traders. Besides, it takes a lot of time and effort to master the complex workings and applications of the trading bots. Moreover, beginners are at the risk of security issues that include manipulation, hacking, and phishing. Also, some fear that the trading bots have dominated the cryptocurrency market and are "manipulating" outcomes.

Conclusion

The consolidation of AI and blockchain technology keeps driving cryptocurrency trading in amazing ways. Beating odds and mitigating risks but not devoid of challenges, cryptocurrency trading bots are constantly being empowered by AI to help users explore mainly data-driven, easy, and gainful cryptocurrency trading on designated exchanges on the cryptocurrency market.

Author: Mokutmfon John Emmanuel

About the author

Email: kutiiejohn@gmail.com

Twitter: @thekukuye